owe state taxes how to pay

People who have earnings and enough connection to the state will have to pay additional. You can give yourself a raise just by changing your Form W-4 with your.

How Much Money Do You Have To Make To Not Pay Taxes

Pay personal income tax owed with your return.

. The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy. You want to confirm that you are withholding the appropriate amount based on your income credits or deductions and filing.

If you owe state taxes youre probably wondering how to make payments. If you owe taxes to your state the best thing to do is pay them in full when you file your return. If you owe taxes you may receive a call from our Phone Power unit at 855 556-4230.

End Your IRS Tax Problems - Free Consult. Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent at 1-877-252-3252. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown.

End Your IRS Tax Problems - Free Consult. If you have taxes owed in the File section of the program you are given options on how you want to pay. You can pay your Individual Maryland taxes with a personal check or money order if you prefer not to pay electronically or with a credit card.

Start by looking at your withholdings from your paycheck. Pay including payment options collections withholding and if you cant pay. 10 of tax due or 50 which ever is greater.

Alabama Failure to File Penalty. If you cant pay your state tax bill in full its important to get in touch with your state tax agency. Its tax sits at 133.

The Different Types of. To create an account as an individual you will need your SSN and you state AGI. How to Pay State Taxes.

Here are the five most common reasons why people owe taxes. If you cant pay your state tax bill or you receive a notice. Line 2 Individual Use Tax - If you made purchases online or out-of-state and did not pay sales tax you may owe CT use tax.

If you owe tax that may be subject to penalties and interest dont wait until the filing deadline to file your return. This isnt always possible however. You can pay by check or money order with a payment voucher Form.

See IP 20193 Q A on the Connecticut Individual Use Tax. Pay a Bill Pay a Bill To pay a bill received by mail you will need the Letter ID and Account Number. Mail your return and payment to.

Ad BBB Accredited A Rating. California for instance has the highest state income tax rate in the United States. Answer Simple Questions About Your Life And We Do The Rest.

Failure to Pay Penalty. If including payment of taxes owed when mailing your Indiana income tax return print your SSN and tax year on the check or money order. Payment Plans for Qualified Applicants.

Your state may allow you to set up an installment payment plan to pay whats. You can return calls to this toll-free number or call it if you have a question about the. Send an estimated tax payment or file early and pay as much.

You have a few options such as writing a check transferring funds directly from your bank. There are 43 states that collect state income taxes. Ad BBB Accredited A Rating.

If you file electronically and pay by check or money. Too little withheld from their pay. Dont ignore your debt.

Ad Calculate your tax refund and file your federal taxes for free. Included in that print out should be filing instructions along with a payment voucher. You received a letter.

You filed tax return. File With Confidence Today. If you did not set up a direct payment plan while completing your New York State tax.

You can pay or schedule a payment for any day up to. One common question is why do we pay taxes. The department may offset any money owed to you from a state or federal tax refund to either shorten the duration of your IPA or pay your balance in full.

Alabama State Income Taxes Online Payment. To find out how much. State taxes are imposed for multiple reasons.

What you may owe. The Department of Revenue will always attempt to work with you in order to pay your debt but you must contact us. You may pay your income tax estimated income tax and any Vermont tax bill online using one.

Pay income tax through Online Services regardless of how you file your return.

Working Remotely From Different States You Could Face Additional State Taxes Next Year Remote Work State Tax Mobile Worker

Irs Audit Svcpaus Com Small Business Bookkeeping Filing Taxes Tax Debt

Understanding Your Tax Withholdings City Girl Savings Best Way To Invest Understanding Understanding Yourself

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

It Is Tax Season And People Will Be Getting Tax Returns Spend You Tax Return Wisely Tax Season Personal Finance Tax Return

3 Simple Ways To Pay Your Tax Liability Tax Queen Owe Taxes Tax Debt Tax Deductions List

Criminals Are Putting Old Tax Returns Up For Sale On The Dark Web Tax Forms Tax Season Income Tax Return

Get Organized For Tax Season Read Tips And A List Of Items To Gather Before Your Tax Appointment This Could Either B Tax Appointment Business Tax Income Tax

No Title Financial Literacy Worksheets Literacy Worksheets Personal Financial Literacy

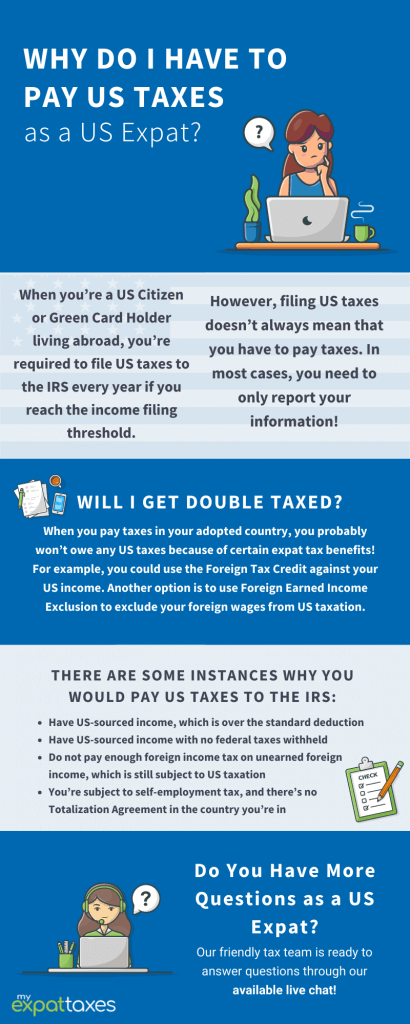

Paying Us Expat Taxes As An American Abroad Myexpattaxes

Estimated Income Tax Payments For Businesses Have To Be Paid Quarterly Here Is The Schedule Break Small Business Accounting Bookkeeping Business Business Tax

What Is A Tax Liability Estimated Tax Payments Tax Debt Tax

Want To Pay Your Nanny Legally But Not Sure If She Ll Go For It Nanny Interview Nanny Tax Nanny

Turbotax Workflow Design Google Search Turbotax Credit Card Application Form Tax Software

Irstaxdebtresolution Tax Problems Merit Professional Help When Individuals Cannot Pay Tax Liabilities Of 10 000 Or More T Irs Taxes Tax Debt Tax Relief Help

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuable Inf Accounting Services Small Business Accounting Payroll Taxes

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Business Business Advice Business Tax